WASHINGTON – Treasury Secretary Timothy Geithner acknowledged continued weaknesses in the financial system yesterday, citing declines in consumer lending and higher costs for credit despite billions of dollars of government money for financial institutions. At the same time, the International Monetary Fund predicted U.S. financial institutions could ultimately lose $2.7 billion from the global credit crisis and said U.S. banks may need $275 billion in new capital. Geithner told members of a congressional oversight panel that despite the ongoing crisis, the government’s financial rescue policies were showing signs of progress, including increases in the number of refinanced mortgages and signs that credit conditions have improved. ‘We need a financial system that is not deepening or lengthening the recession,’ he said. ‘Meeting this obligation requires actions by the government; it requires the government to take risks.’ The stock markets appeared to take a positive view of Geithner’s testimony, including his assessment that ‘the vast majority’ of banks could be considered well-capitalized. Bank stocks slid on Monday, but bounced back after Geithner’s comments. His testimony came in the wake of a watchdog agency report that warned Obama administration initiatives could increasingly expose taxpayers to losses and make the government more vulnerable to fraud. Neil Barofsky, a special inspector general assigned to the bailout program, concluded in a 250-page quarterly report to Congress that a private-public partnership designed to buy up bad assets is tilted in favor of private investors and creates ‘potential unfairness to the taxpayer.’ Geithner said the new plan is ‘better than the alternatives’ by letting taxpayers share the risk with the private sector while at the same time letting private industry use competition to set market prices for the assets. ‘That is a better model than having the government itself come in and independently try to value these things,’ Geithner said. ‘

Latest Stories

- Falcons flock to Florida for the Disney College Program

- BG24 Newscast

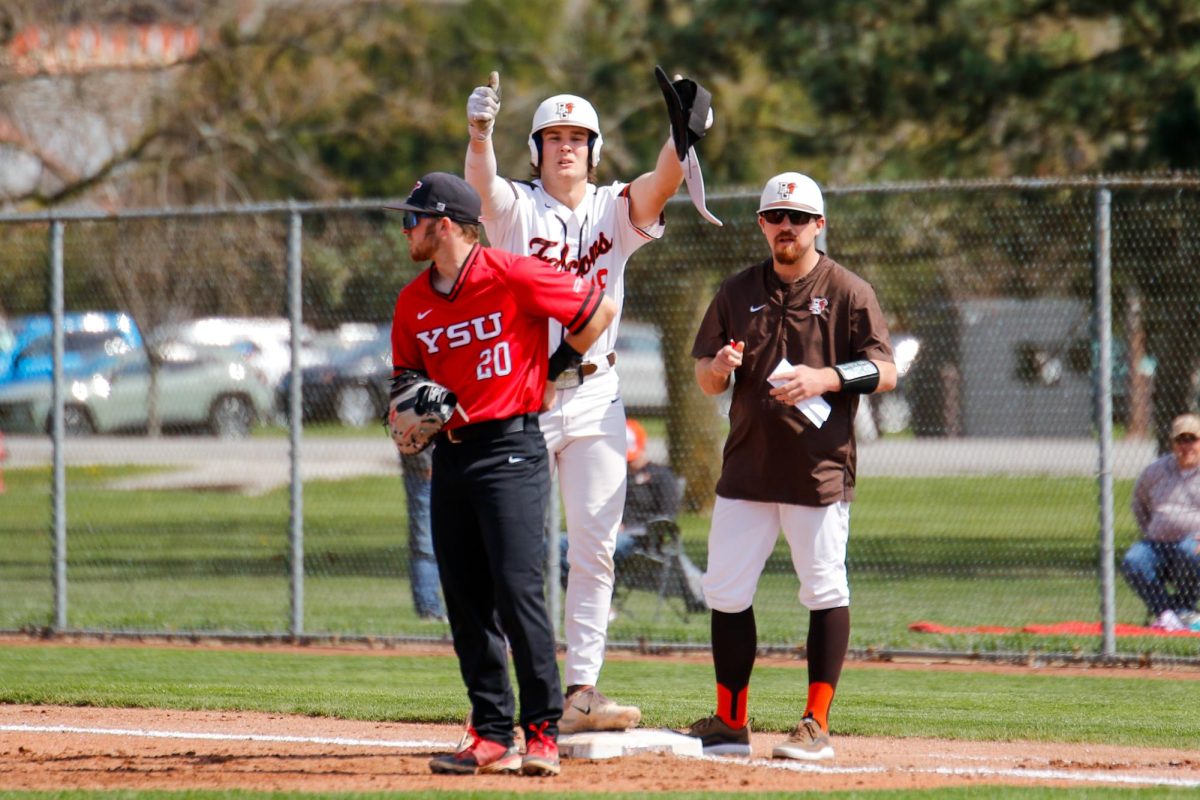

- BGSU baseball vs Ohio preview: Falcons’ storybook season continues with homestand against Bobcats

- From the Golden State with a golden opportunity- Justin Eklund makes his way to BGSU

- 74% percent of women in the U.S. are embracing makeup: What's behind the trend?