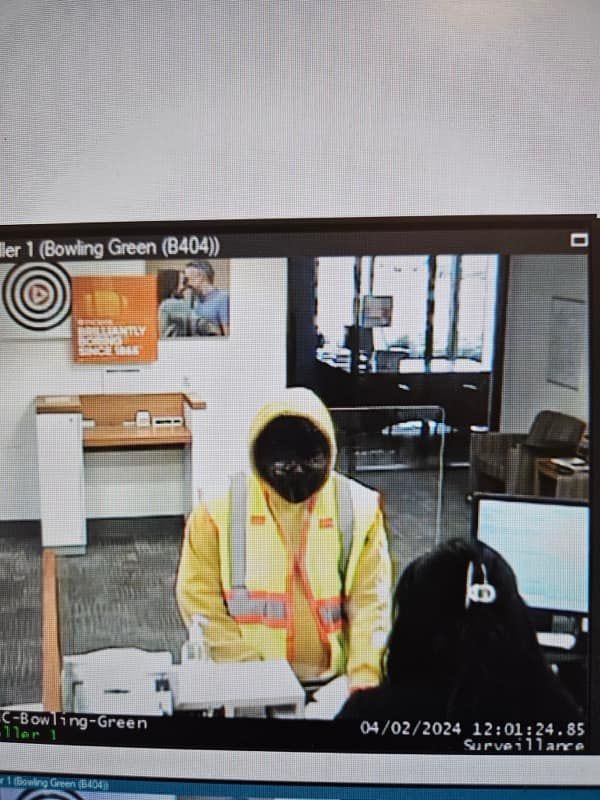

The city of Bowling Green is facing a deficit of $627,000 dollars for the 2017 fiscal year, which started Jan. 1 and ends Dec. 31, 2017.

The total proposed budget is $62,996.672 for the 2017 fiscal year.

This projected deficit is a number tied to a specific budget item labeled as the General Fund, which is used to pay the majority of day-to-day expenses incurred. This does not include utilities.

The listed deficit for 2017 is a big dip from the $250,000 surplus in the 2016 General Fund budget.

“This causes us some concern,” said Robert McOmber, a city council member and chair of the Financial Committee. “It’s a bit alarming that we are adopting a budget that shows we are bringing in $627,000 less than what we are spending this year,” he said.

The total budget for the General Fund in 2017 is $14,996,197, a large contrast to pre-recession levels. For comparison, the peak city earning from 2007, listed in the city’s 2017 Budget Executive Summary, was $15,783,746.

The loss in revenue is hard to trace to a single item. Income tax, the city’s largest source of income, has risen from 2011 to 2016 (an average of 4.89%) according to the Executive Summary document.

The city used to have an income tax rate of 1.9%, which was the lowest in the area, but the city increased it to 2% to align itself with surrounding areas and has no plans to change this number.

“I’m not talking about an increase in the rate,” McOmber said. “I am dead set that the 2% we charge now is something that should be maintained indefinitely, but not increased.”

Even though it is the largest income source, not all of it is applied to the General Fund. McOmber said over half of it is spread among other city funds.

A chart explaining the breakdown of income tax collection shows, out of $100, only $37.50 goes to the General Fund.

From 2007 to 2017, the income tax revenue for the city has increased by $1.6 million dollars. The city also projects a 4% increase in income tax receipts from 2016 to 2017.

McOmber said people wonder why the General Fund can see this kind of deficit if the income tax revenue is up.

“Basically the expenses that have been paid out of the fund for a number of years have been rising at a faster rate than the revenues have been rising,” he said.

McOmber points to changes in the state policies regarding money shared with local governments. “The state passes money to us that is out of their revenues,” he said. “That number has gone down significantly.”

It is a two-part problem.

First, Ohio abruptly dropped the Inheritance Tax, which is essentially a tax on a deceased person’s income. Money from the Inheritance Tax for Bowling Green was approximately $600,000 prior to its cancellation.

Second, Ohio decreased the amount of money shared with cities through the Local Government Fund. Before the state cut the fund in half, Bowling Green received approximately $1.3 million. Since the cut in 2012, only approximately $650,000 has been received.

“The way I see it,” McOmber said, “increases in income taxes over the years is negated by the loss of (state funds). We would be sitting very pretty if we still had that income.”

$500,000 has also been lost from interest on Certificates of Deposit. The city used to pull 4% interest on these CDs, but now only around one-tenth is made.

“Add that into the mix and you can start to see why we have less revenue from 2016 to 2017, and why we are looking at a potential $627,000 deficit,” McOmber said.

A deficit does not look good on a city budget, but McOmber said it is “not a crisis.”

“We are not going to run out of money this year or next year,” he said.

Keeping the city afloat when there is a deficit comes from the city having access to a carry-over balance.

The carry-over balance, as described by McOmber, is an unused balance in the budget that persists from year to year. The current estimate for this balance is $3.9 million. This number comes from the addition of $750,000 ($250,000 surplus and an estimated $500,000 in unused, previously appropriated funds) to the previous carry-over balance of $3.16 million.

The carry-over acts as a safety net for budget expenditures only so long as it stays above $0 – though McOmber said if the carry-over balance drops below $2 million he would feel uncomfortable – it is a patch that can be applied, but not a crutch to rely on.

“We can’t use up the carry-over balance and then keep spending more than we bring in,” he said. “If it turns out that we have a $600,000 deficit in 2018 and $1 million the next year, you can’t just let that go on for a few years without doing something about it.”

The big hopes for 2017 are a continued increase in income tax through the addition of more people to the local work force and continued prudence from department heads in their spending.

The start of 2017 looks bad, but by the very nature of budgeting, things could turn around as the year progresses.

Bowling Green creates the budget with a conservative mindset, estimating revenue at the realistic lows and expenses at realistic highs.

McOmber said looking at the history of his time on council, the city rarely spends all appropriated funds and brings in more money than anticipated. He looks for the deficit to be closer to a couple hundred-thousand dollars in the future, maybe even break even if luck is on the city’s side.

“I don’t want to scare anybody,” he said. “I don’t know what actions we will have to take. We might not have to take any actions at all.”