By Bob Condor Chicago Tribune (KRT) Making a significant change in your life is easier with the right support. Po Bronson, author of the current best seller “What Should I Do with My Life?” (Random House, $24.95), interviewed hundreds of Americans about his title question. One common denominator is it helps people “to hear it’s not crazy that you want to change your life.” Bronson said each of us should reassess who is in our inner circle of advisers. It might be time to “replace some of the people at the table,” he said. Another important move: Be yourself. “Lots of people turn off their voice (by sticking to a daily routine that is more rut than reverie),” said Bronson, author of two successful novels. “We can make the mistake of half-listening to what’s inside of us.” Paying full attention can motivate changes, but a breakthrough step might seem next to impossible by glancing at bank account. Don’t let money stop you, said author and financial adviser Stephen M. Pollan. Among all of the general barriers to what Pollan calls “your second act,” money is actually the easiest to overcome. That’s because we can control a good portion of what we spend. One of the most influential choices is deciding what percentage of income to spend on housing. Reducing this amount can go a long way toward financing your life change, said Pollan. In his new book “Second Acts: Creating the Life You Really Want, Building the Career You Truly Desire” (HarperResource, $22.95), Pollan offers detailed plans for increasing income and reducing expenses. To increase personal revenue, he recommends these possible strategies: Ask for a raise, take a part-time job, increase your rates, collect your inheritance early, convert assets to cash (and live up to your New Year’s resolution to clear the clutter from your life), rent your home when you travel and reassess your investment accounts (no matter how modest). Plus, Pollan suggests the conversion of assets into revenue streams while still alive, a process he described in his bestseller “Die Broke” (HarperBusiness, $15) to avoid the burden of estate tax for heirs and live your dreams more readily. Remember that each strategy needs your breakthrough step to be the goal. Asking a relative for a loan to pay off a car so you can trade up for a bigger car is not the same as using the car sale proceeds to pay for certification courses as a real estate broker, for instance. Decreasing expenses can be easier or harder depending on your personality type. Some ideas from Pollan focus on bigger savings rather than pennies here or a few dollars there: Refinance your mortgage (again), consolidate your consumer debt (he specifically recommends www.lowcards.com for possible services and Quicken software for background information), relocate to lower your cost of living, lease rather than buy your car, trim homeowners/auto/life insurance policies (prudently) and hire experts who can help with a property-tax appeal or saving on income tax. To simply get a jumpstart on a new path, such as finding the funds to pay for a class, Pollan said look no farther than your cash spending during a typical week or month. He writes that “most people can’t account for almost 60 percent of the cash they spend.” You might be surprised how close your breakthrough step might be. ___ ‘copy 2003, Chicago Tribune. Visit the Chicago Tribune on the Internet at http://www.chicago.tribune.com/ Distributed by Knight Ridder/Tribune Information Services.

Latest Stories

- Falcons flock to Florida for the Disney College Program

- BG24 Newscast

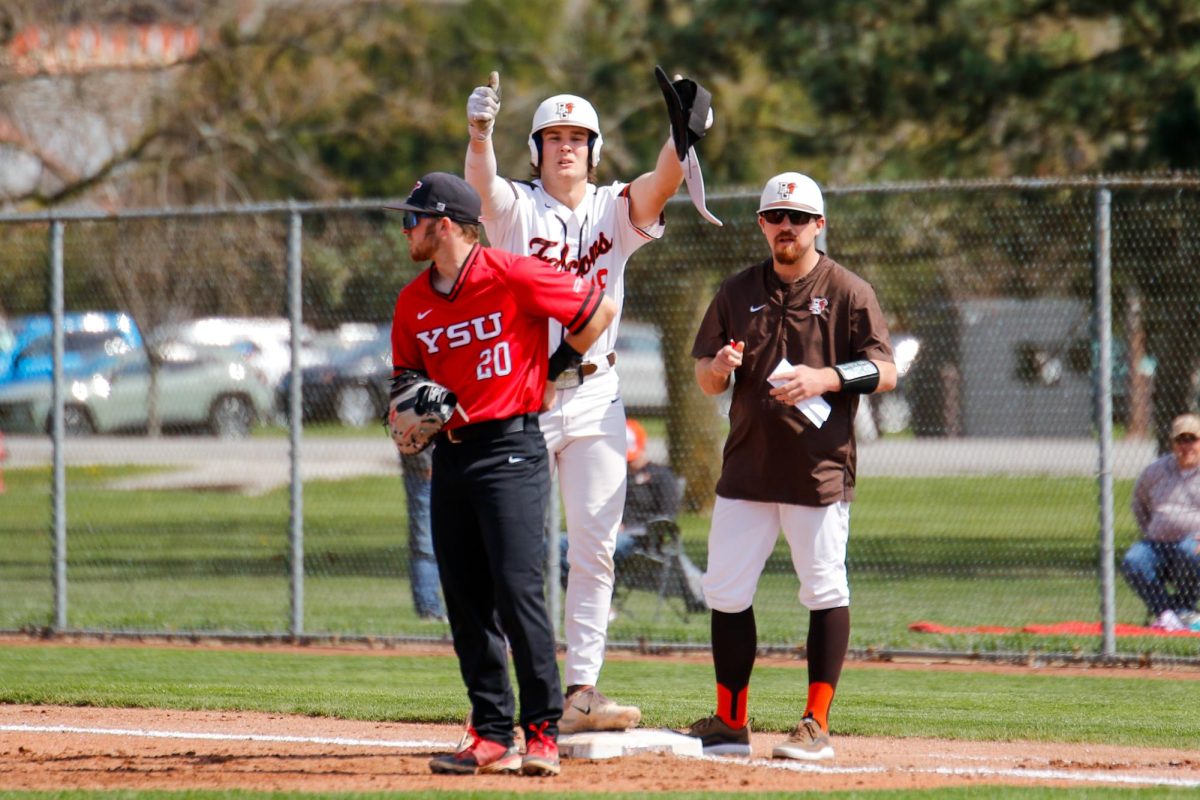

- BGSU baseball vs Ohio preview: Falcons’ storybook season continues with homestand against Bobcats

- From the Golden State with a golden opportunity- Justin Eklund makes his way to BGSU

- 74% percent of women in the U.S. are embracing makeup: What's behind the trend?