College tuition has been climbing here in Ohio and across the nation for the past few years. The University is not exempt from these tuition hikes.

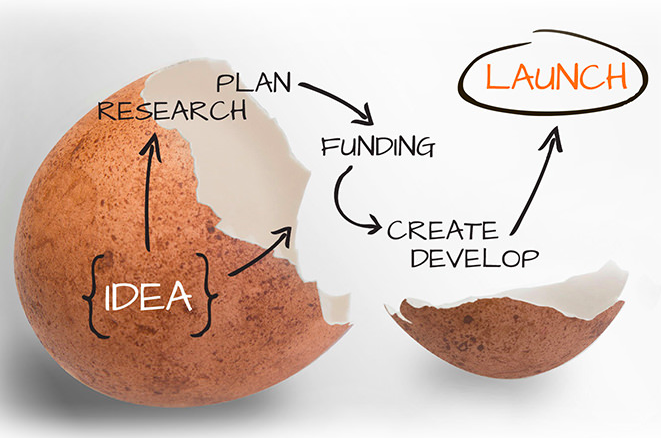

With these factors, many students are asking themselves (and their parents) “How am I going to pay for college now?”

Some students are fortunate enough to have their college tuition paid for in full by their parents, whether it be a loan or a gift. However, for those students who do not share in this luxury, they must rely on other forms of financial aid.

Some common forms of financial aid are scholarships, grants, work-study programs and student loans. According to Craig Cornell, director at the Office of Student Financial Aid, about 50 percent of students using financial aid are taking loans —- making it the most common form of financial aid.

Students rely on loans to pay for tuition because they can’t find a job that pays well enough or a class schedule that allows them to work 40 hours. Even if they find a way to work 40 hours a week, it is unlikely that the job will pay enough to pay for housing expenses, books, food and tuition costs. Thus, it is nearly impossible for a student to go through their college career without utilizing some form of financial aid.

However, students must be careful not to abuse the financial aid system —- especially loans.

The primary purpose of financial aid is to help students pay for college tuition. Still, there are some students who rely on loans to pay for other expenses such as rent, on-campus living costs, car payments, insurance payments and other various bills. This is a mistake.

Loans, as we are sure you all know, have to be paid back at some point in time —- with interest. That is the key word: interest.

What this means is that after you pay for college completely, you will still have money left to pay on the loans due to interest. In fact, according to www.newspress.com, the average college student racks up $17,000 in debt while completing their bachelor’s degree.

This statistic should be a warning to those students who use loans to pay for expenses other than tuition. Heed the warning and get a part-time job, even if you have to work on the weekends or at night. Try and schedule your classes so that you can either work in the mornings or in the evenings.

Most students would benefit from having a job while going to school. It helps them prioritize their time and it teaches them responsibility. Granted, it may be rough having a job and going to school at the same time, but you will save money in the long run.