Of the many rights and protections given to us by the United States government, it now appears we have the right to be bailed out when we make bad mistakes or do unethical things.

On Dec. 6, President Bush announced plans for a five-year freeze on mortgage rates for sub-prime borrowers. This was done in an attempt to stop the rate of foreclosures and default starting to occur in America.

Sub-prime mortgages are offered to people who have bad credit and are charged a higher rate by the banks due to the increased risk. The terms of these mortgages are unfavorable to the borrower, but then again, all of this is disclosed to them by law.

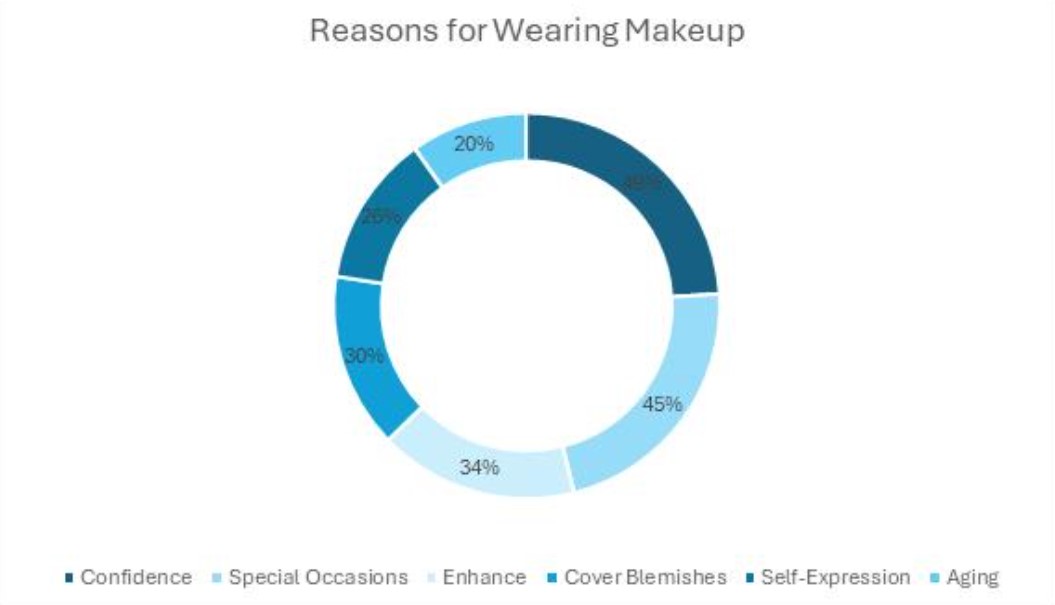

The reason why the system is suffering is because the total number of sub-prime loans has risen to 20 percent, up from only 8 percent in 1996.

The problem is that the government is bailing out tons of people that acted stupidly. These people did unthinkable things, such as living way beyond their means and amassing a mountain of debt with no way to pay it back. These same people then started to buy houses without understanding the terms of the programs they signed into.

Some also decided to engage in the intelligent practice of taking a second mortgage or refinancing and spent the money on consumer goods. This was an OK practice once the market and financial status of borrowers held out.

Once the market and time caught up with the borrower, things started to fall apart.

Very little of this problem can be assessed to lenders since they already have to fully disclose everything and have scores of federal and state laws to follow.

But a large amount of responsibility rests at the feet of the homeowners themselves. What kind of person gets into making one of the biggest investments of their life without knowing what’s going on?

Ignorance of how credit and debt work is not an excuse to cause financial havoc. We don’t tell crackheads that it’s OK that they did not know about the effects of smoking crack when they started smoking.

Unlike normal, responsible people that work their way up the ladder by spending and saving in a rational manner, some decided to get rich quick and hope the bubble held out for them.

They gambled with the future of their families and their financial future because they were not willing to wait.

George Mason University has also found that 70 percent of payment defaults came from those that filed fraudulent paperwork, in some cases claiming five times their actual income.

This should shift the blame from the scapegoat of predatory lending to the rightful “predatory borrowing.”

And to put things in perspective, according to Wells Fargo, 96 percent of mortgages are being paid on time. This means that only a minuscule 4 percent are struggling in this so called “Mortgage Meltdown.”

Something else we as future homeowners and contributors to society need to consider is that the only way this freeze will become effective is by having someone paying for it.

By “someone,” I mean us. We will be paying for the poor decisions of other people who made bad gambles or tried to lie and cheat banks.

Not only is the policy of subsidizing considered bad decision making as well as fraud, it also prevents people that can rightfully buy a home from doing so.

These over-inflated housing prices are kept artificially high by the frozen rates. This prevents anyone from buying a home at its true value.

What will we do in a few years when we realize that many of these sub-prime borrowers still can’t hold onto their houses? Many of them simply should have never owned a home as big or expensive as they do now. Are we going to give them do-overs?

Banks lent money and people took out loans. This is no different than it has been in the past. Now, simply because a few people can’t make their payments and now that they realize they’ve made a bad choice in lying or gambling, the government is swooping in to save them.

If this is the case, why isn’t the US government looking to bail out those that lose their kids’ college funds in the casinos of Atlantic City and Las Vegas?

They just happened to have bad luck too, it’s not like they were irresponsible or foolish.