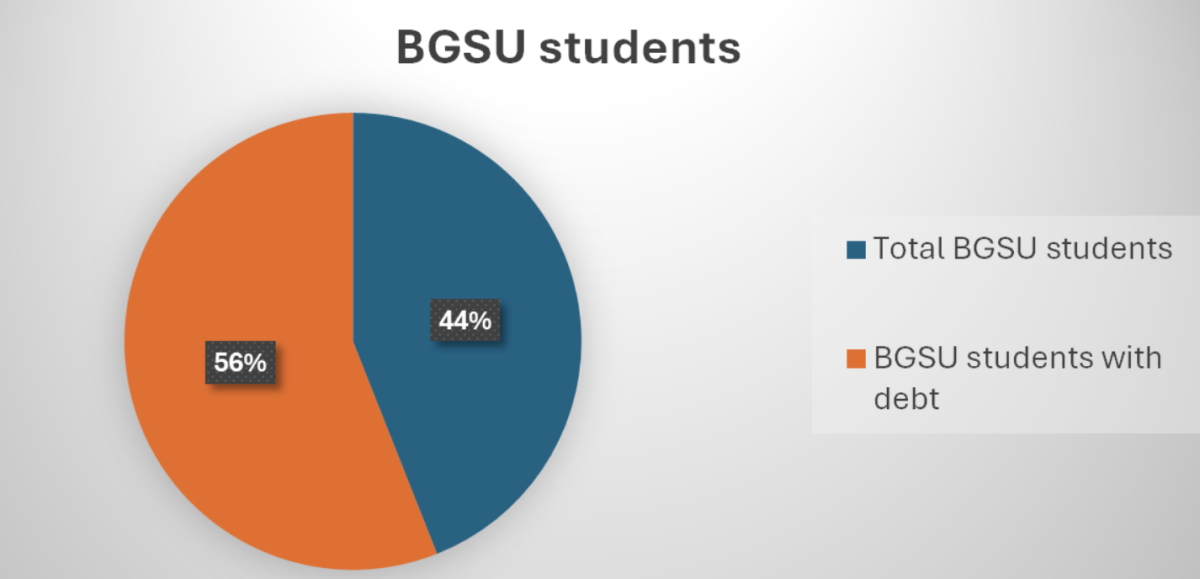

56% of BGSU students receive federal loans and typically graduate with $25,000 in debt, according to data from the U.S. Department of Education.

While this number is lower than the average amount of student debt compared to other colleges and universities, student debt still greatly impacts BGSU students.

The cost of college education has increased by 180% since 1980, according to a 2023 Forbes article citing the National Center for Education Statistics.

One reason tuition costs have risen is because government funding for higher education in Ohio decreased between 2006 and 2023 from $1.95 to $1.93 billion, according to Policy Matters Ohio, leaving a $20 million gap in higher education funding.

However, BGSU has taken several steps to help alleviate the burden of student loans.

This summer, BGSU alumni Bob and Ellen Thompson announced a gift of at least $121 million to support the university’s Thompson Scholarship Programs, and as of 2022, 77% of BGSU’s undergraduate students received some kind of grant or scholarship aid, according to the National Center for Education Statistics.

BGSU also offers the Falcon Tuition Guarantee, which guarantees that for a four-year degree, a student’s tuition rate will not increase from their first year until they graduate.

Still, for many BGSU alumni, including Sydney Wilke who graduated in the Spring with a degree in career tech workforce education, the opportunities available to offset the cost of college weren’t entirely successful.

“I essentially did everything I could to have the least amount of loans, and I left with $27,000… I didn’t buy any meal plan. I had a Pell Grant. I tried to get any scholarship that I could. I didn’t end up getting any, but I really tried every year for scholarships,” said Wilke.

Wilke isn’t alone. A recent survey from YouGov found 84% of U.S. adults blame colleges and universities to some degree for student loan debt.

While U.S. adults attributed blame for the student debt problem to other entities such as banks, the government and college students, the YouGov survey shows people blame colleges and universities more frequently than other entities for student loan debt.

Justin Rex, a BGSU professor of political science, said increasing frustration with student debt has been demonstrated by various political movements including President Biden’s student loan forgiveness and the Occupy Wall Street movement.

“There’s been kind of a shift towards people being more fed up with student debt that this should be a public good largely paid for by taxpayers rather than by individuals,” said Rex.

While Wilke doesn’t blame BGSU for her debt specifically, she agreed that she attributes blame to colleges and universities generally for student debt.

“I think colleges put outrageous fees on things,” said Wilke.

Wilke said one reason her loans are higher is because she was assigned the wrong advisor freshman year. As a result, she was behind on graduation and had to take a summer class and a 21-credit-hour semester to graduate on time, costing her more money.

“I think if the school would have correctly seen my degree, and put me with my correct advisor, she would have helped more than my original advisor did right from the get-go,” said Wilke.

While Wilke and many other Americans are negatively affected by student debt, Kevin Quinn, an economics professor at BGSU, said student debt isn’t always bad.

“A student loan is still a reasonable thing to do,” said Quinn.

Quinn said student loans become economically problematic when individuals are unable to save money or spend on things other than loan repayment because their debt is so high, which shifts economic demand for other goods and services.

Quinn also said for a healthy economy, individuals need to find a balance between spending money on goods and services and saving to invest in things later.

“In the short run, we want spending to be high because otherwise we’ll have a recession and there’ll be unemployment. But over the long run, we also want people to save, because saving is going to give us the ability to produce at a greater level in the future,” said Quinn.

Student debt also has long-term impacts on students. Wilke’s payment plan is over 30 years, which she says is the entire length of her teaching career.

For more information and statistics about student loan debt visit Forbes.